Industries

Banking

The Nordic region is renowned for strong digital innovation and high levels of trust in financial services.

Our focus is upon responsible technology, specialized financial products, or individual resource needs, for reliable and secure solutions enabling efficient banking operations and exceptional client experiences.

Finance and banking

Our partners

Our financial sector expertise is bolstered by an ecosystem of tech providers, partners and communities that we have an active dialogue with about upcoming trends and regulatory changes.

Siili Banking Expertise

Over two decades of experience with the leading Nordic banks

Online and mobile banking

Working in partnership with our client, we have built and maintained a mobile banking application with features like money transfer, expense splitting, and online payments, peaking at more than 1.2 million users.

Cloud technology

We successfully migrated databases to the AWS cloud. The project started with piece-by-piece frontend migration before gradually moving the system to the cloud. We collaborated with the bank’s business, strategy, operations, and legal departments to ensure regulatory compliance.

Saving and deposits

Together with a Nordic investment bank providing crowdfunding and a peer-to-peer lending platform, we provided personal customers and business clients with customer-focused, effortless, and responsible fixed-term deposit solutions.

Cash and liquidity management

We developed Finland’s leading corporate hub for smooth cash and liquidity management, with financial monitoring for companies of all sizes. The service enables easy fund transfers between company accounts and making payments in the Single Euro Payments Area (SEPA).

Investment and asset management

We assisted a Nordic fund management company, with a focus on institutional investors, in revamping their digital services. This emcompassed conceptualization, implementation, and a phased out release of renewed digital services, including a new interface, online banking, and enterprise asset management.

Credit and financing

We built an online service for business loans, enabling corporate clients to manage credits and limits in one centralized platform. Additionally, users can initiate credit withdrawal and renewal orders, access detailed information about credits and limits, and generate necessary reports supporting financial planning.

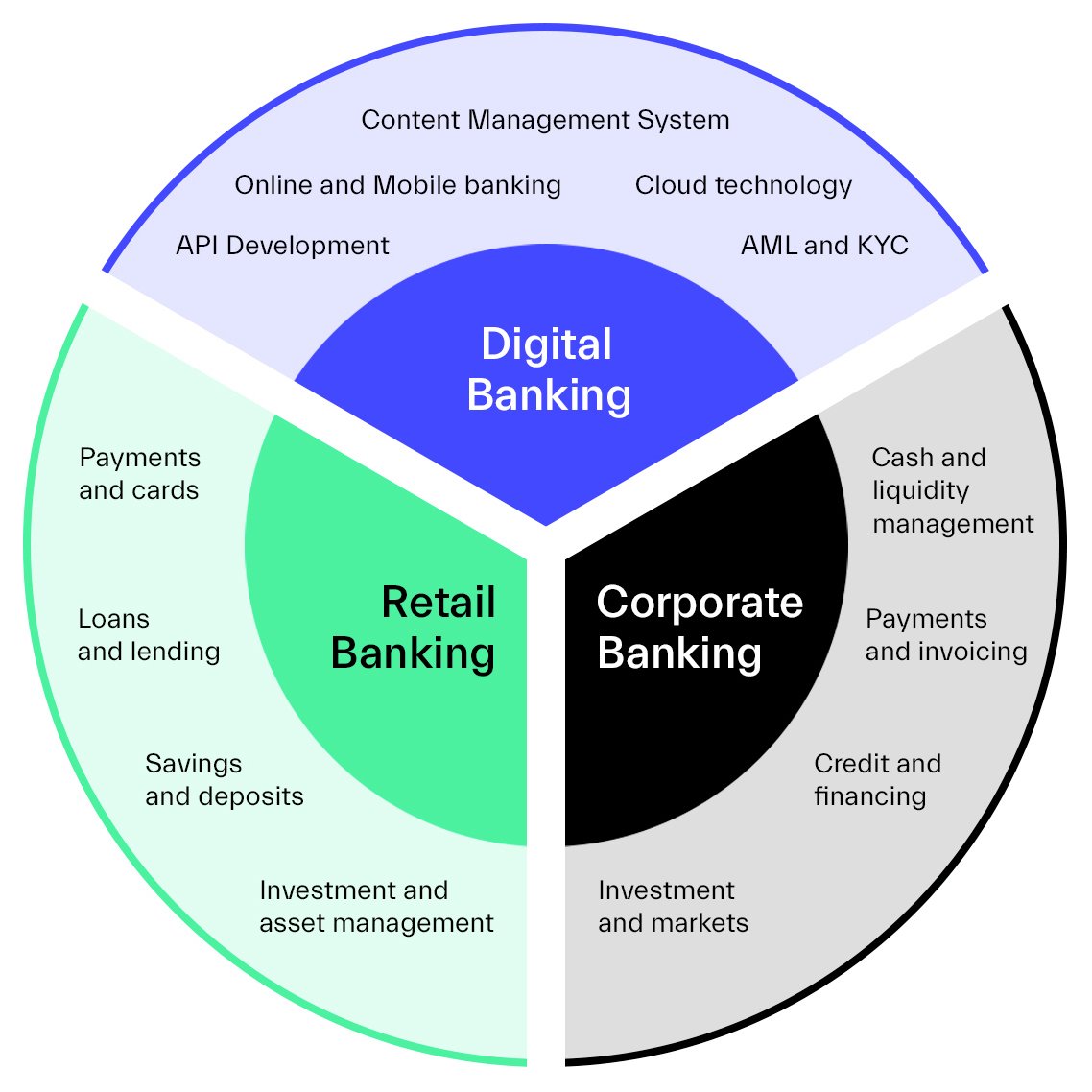

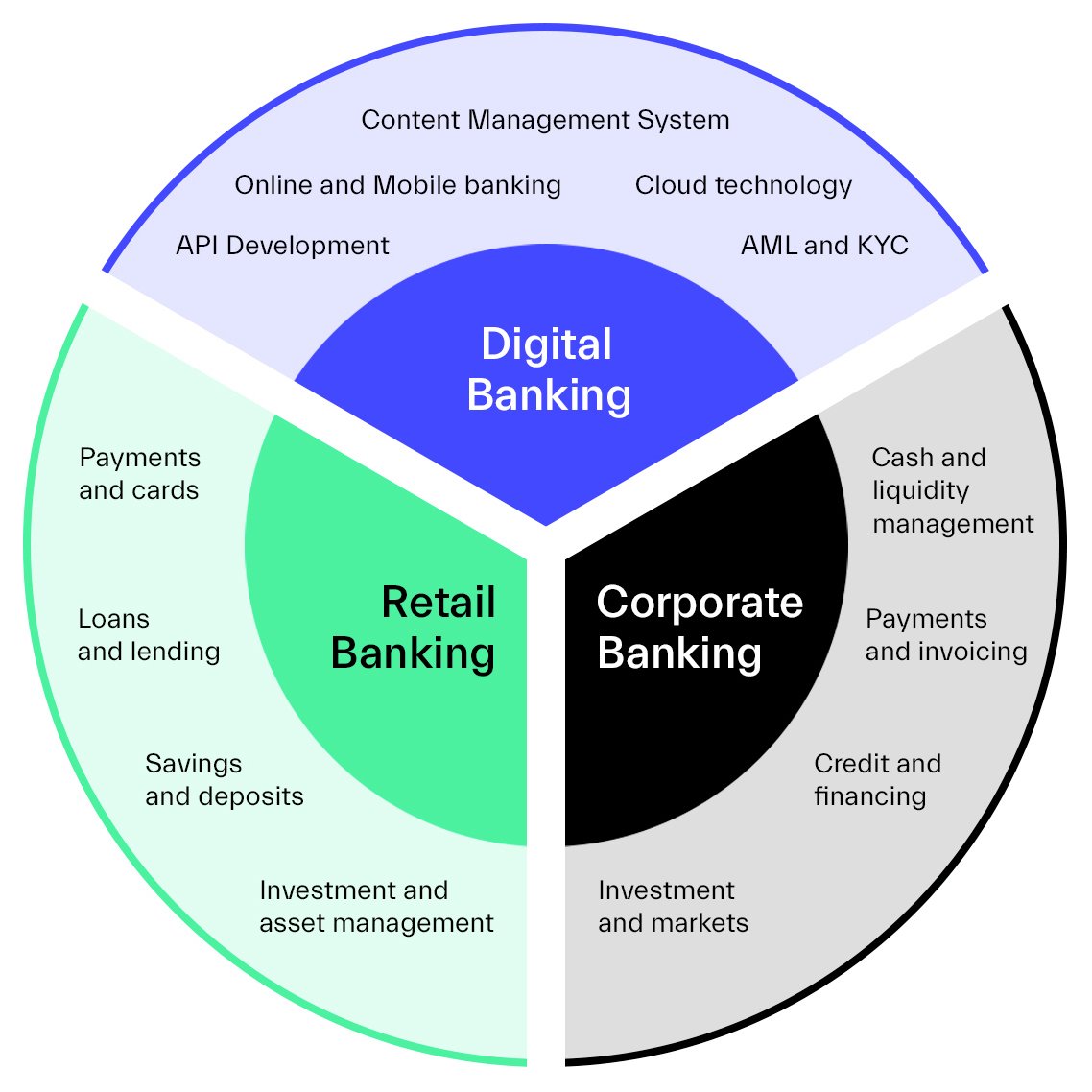

Key drivers for different segments of banking

The Do’s and Don’ts of the Future of Banking

Revolutionizing Banking: Exploring the New Composable Banking Back End

Download our free whitepaper

Siili Banking Services

How we help banks remain competitive in a rapidly evolving market

1. End-to-end Delivery

- Concepting and developing new products, services, or features

- Reviewing and improving existing products, services, or features

- Implementing and integrating selected software into existing technology infrastructure

2. Resourcing

-

Identifying top talent for upcoming project

-

Replacing or reviewing existing resources

-

Providing relevant training

3. Continuous Services

-

Ensure continuity through support and maintenance

-

Continuously improving technology practices to stay competitive and align with trends and client needs

-

Accelerating and optimizing Cloud/DevOps capabilities

Trends in financial services

Digital transformation

Banks invest in digital technologies to enhance the customer experience, reduce costs, and increase efficiency. This includes online banking, mobile banking, and digital payments.

Central Bank Digital Currency (CBDC)

CBDCs are a key trend with the potential to revolutionize payment systems and spur innovation. Banks must remain informed and adaptable as technology and regulatory frameworks evolve.

Offshore vs. nearshore

Nearshore banking operations improve communication, reduce costs, and boost efficiency enabling banks to better respond to changing client demands and market conditions. The choice between nearshore and onshore resourcing depends on the complexity of tasks.

Regulatory changes

Regulatory changes significantly impact the heavily regulated financial services industry. Open banking regulations, for instance, promote competition and innovation in the sector.

The quest for talent

Banks face intense competition in attracting and retaining talent due to technological advancements, evolving skills, labor market competition, and an aging workforce.

Environment, Social and Governance (ESG)

ESG considerations are gaining significance for banks and their clients. Banks are creating ESG-focused offerings, integrating ESG criteria into their lending and investment choices.

Related stories

12.02.2026

The invisible companion handshake: how LLM agents are rewriting the digital economy value chains

That era is ending. We are transitioning into the Companion Economy, a shift where the primary interface for the customer is no longer a website or an app, but...

→Read Post13.01.2026

AI in Product Development: It is all about strategic alignment

Artificial intelligence is redefining how products are conceived, built, and evolved. But the true potential of AI in product development isn’t about...

→Read PostGive us a call

Make IT Real with the help of our experts.

Olli Sorvari

Business Unit Director

Ready to make AI real?

Let’s explore your opportunities, map the path forward, and build reliable, AI-powered solutions that scale — together.